How do I configure the VAT settings?

All your VAT settings can be adjusted in the backoffice under Checkout/VAT & Price display. Here you can configure the following settings:

- Price display: set whether you will display your product prices in- or excluding VAT, in which currency and how you want to display the amounts.

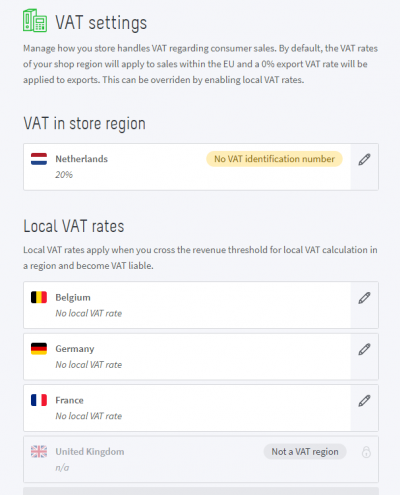

- VAT settings: set how your shop handles VAT when selling to consumers. This topic requires some more explanation:

- Store region

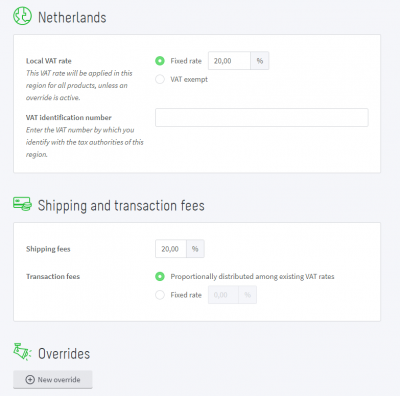

- Your store region is set automatically based on your Store Details. For this region, you can set a local VAT rate. Are you not liable to pay VAT? Then choose 'VAT exempt' here. You also enter your VAT number here.

- Under Exceptions, you can set one or more exception rates. If, for example, most of your products are subject to a 20% rate, this will become your local standard rate. If a smaller number of your products have a VAT rate of 5%, this will become your override rate. We will explain further on how you can subsequently link products to this override rate.

- The VAT on the shipping and payment costs will be distributed proportionally over the VAT rates in the order.

Other regions (only for international sales)

You can also set local VAT rates per country. The regions you have set under Shipping Options will automatically be set as VAT regions.

You can also set a default rate and an override rate for these regions. You then link the products to the override rate, the same way you did for the local VAT region.

You are responsible for setting the correct and current tax rates for the region concerned.

If you use the POS App, the locations where you use the POS App are also added to these VAT regions.

Please note!

If a region is not activated, the tax settings of your store region will be used here.

Linking products to an override rate

If you have set an override rate for your store region or for another VAT region, you can link products to this rate. Click on the pencil icon to edit the region and set a rate under Overrides. You can also set which products should be linked to this rate.

VAT settings in the product editor

When adding or editing a product, you can select whether you charge VAT on the product or not. If you do not charge VAT on a particular product, you cannot select it for an override rate.

Tip

If you are not sure whether you will reach the threshold for calculating local VAT rates, then switch it on anyway. You are always allowed to charge local VAT rates, but if you reach the threshold it becomes mandatory.

More information?

The European Commission created a web page where you can find all the relevant information on the new legislation.